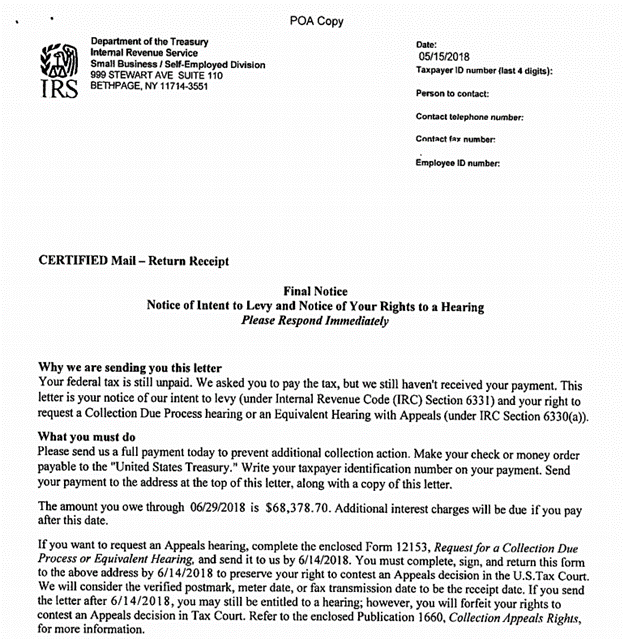

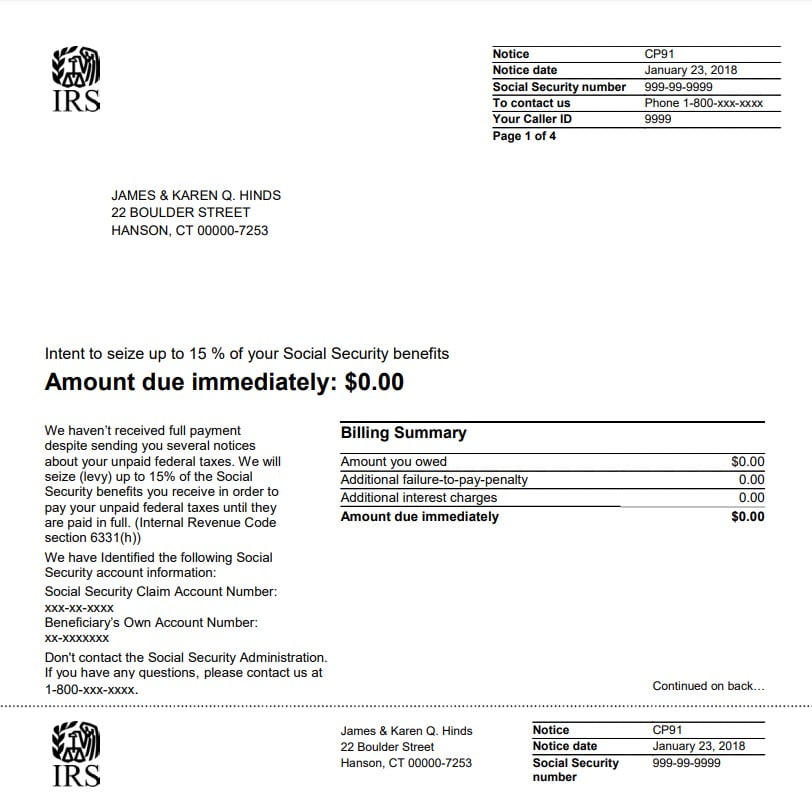

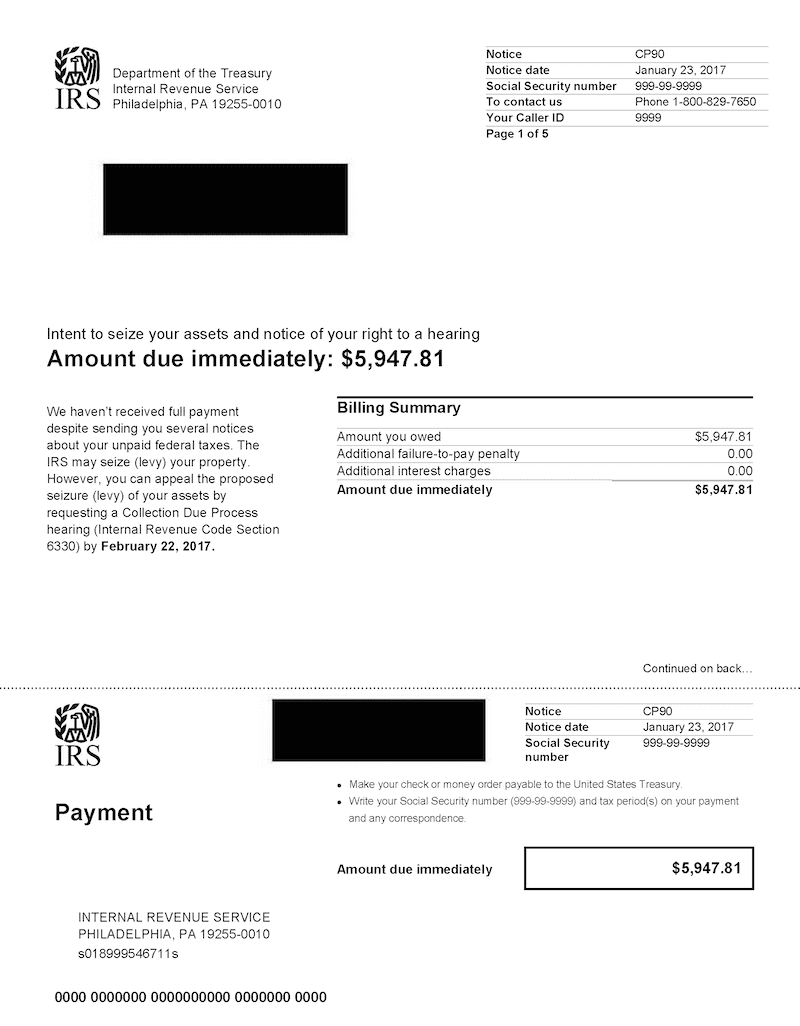

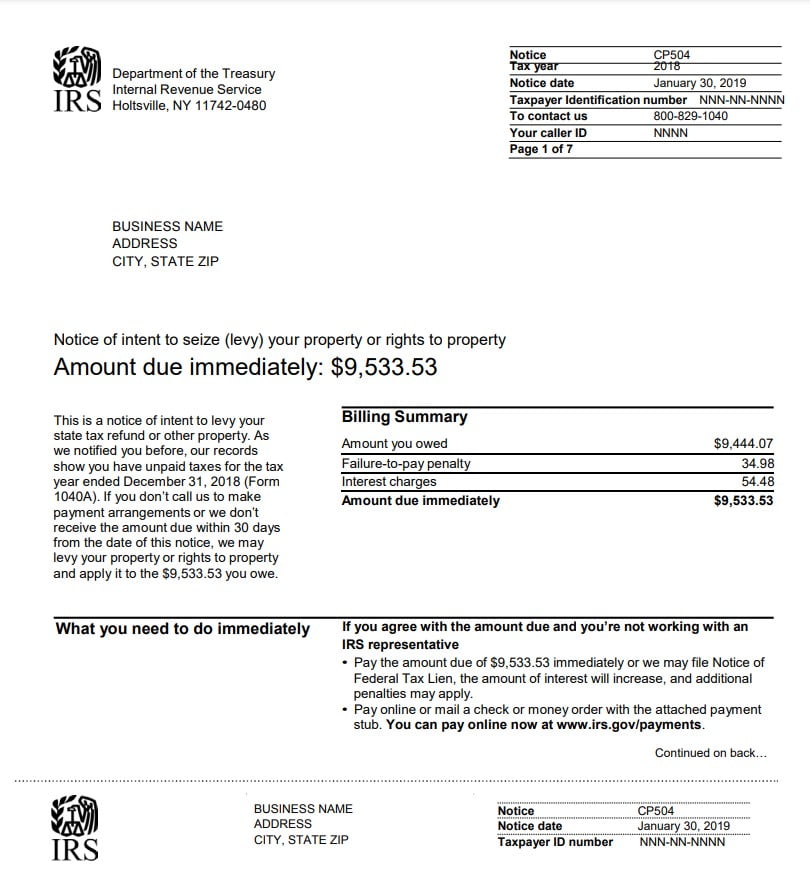

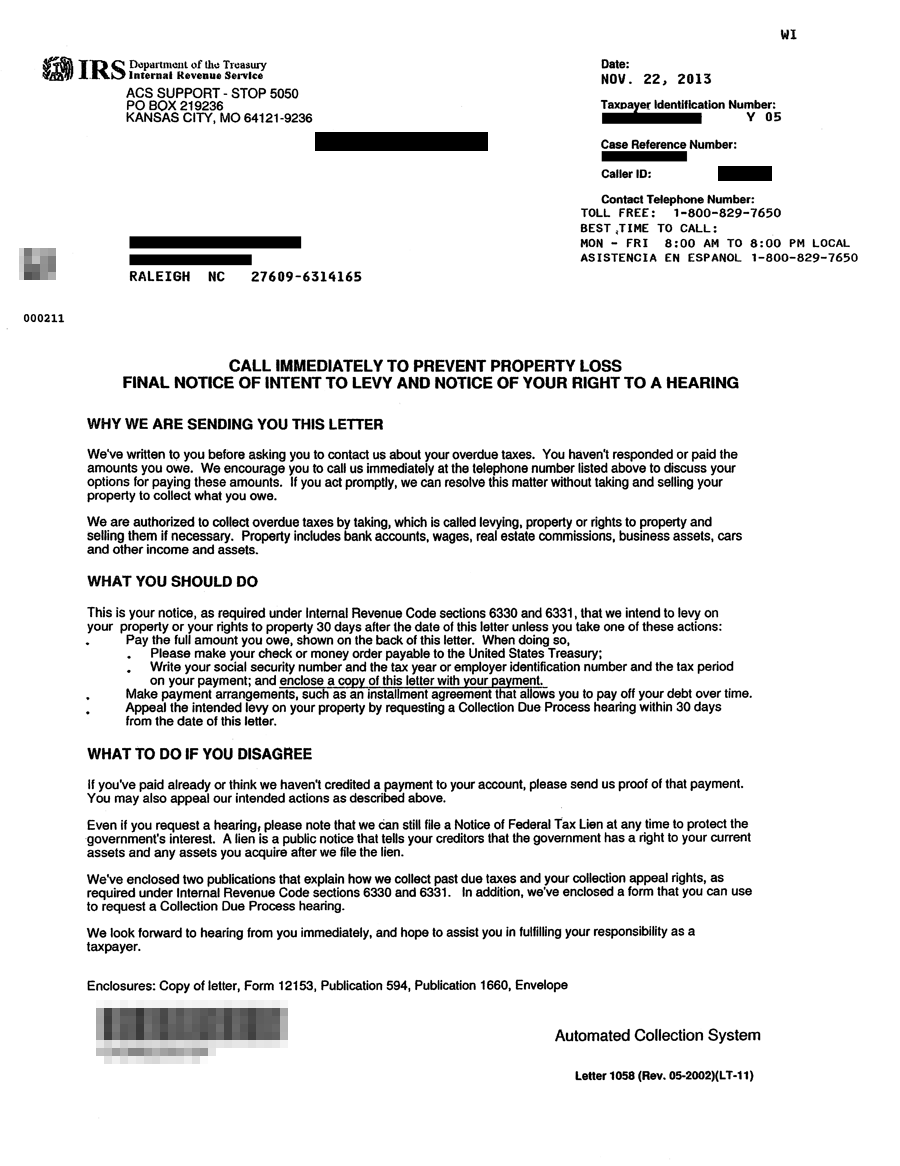

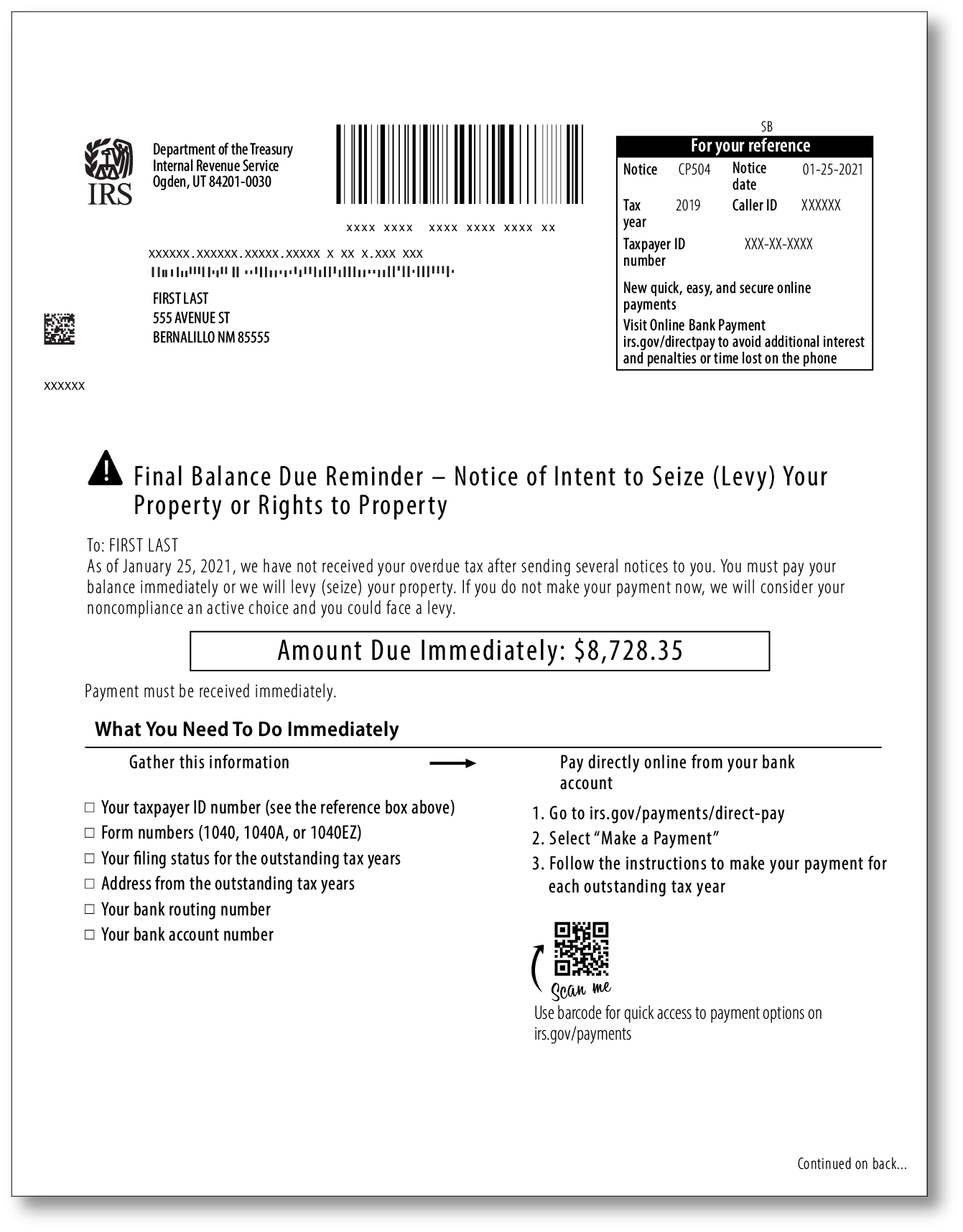

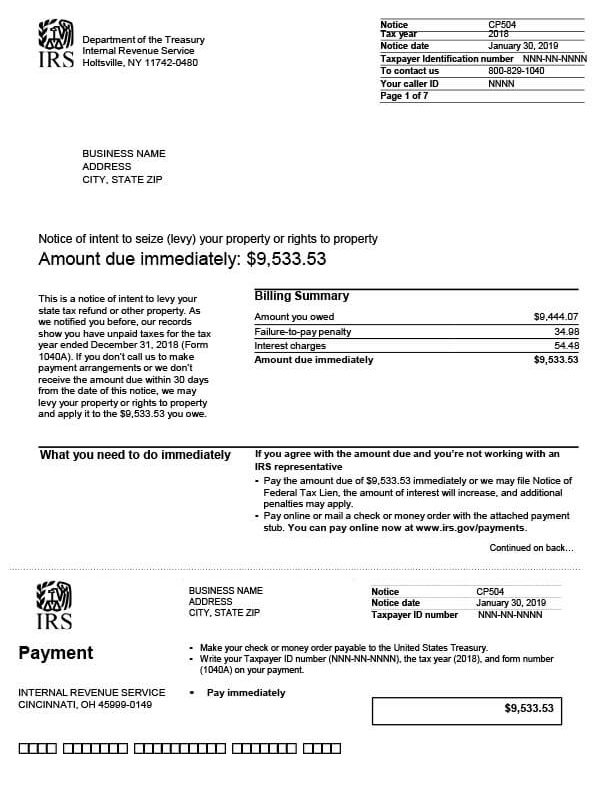

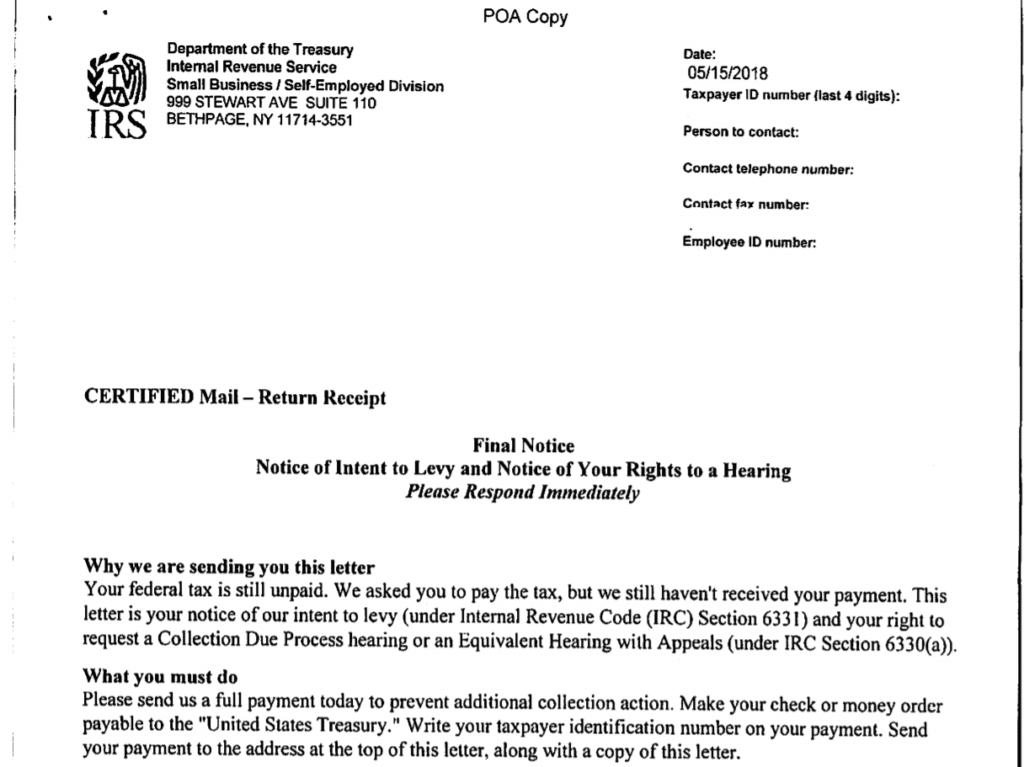

IRS Demand Letters: What are They and What You Need to Know | Tax Resolution Professionals, A Nationwide Tax Law Firm, (888) 515-4829

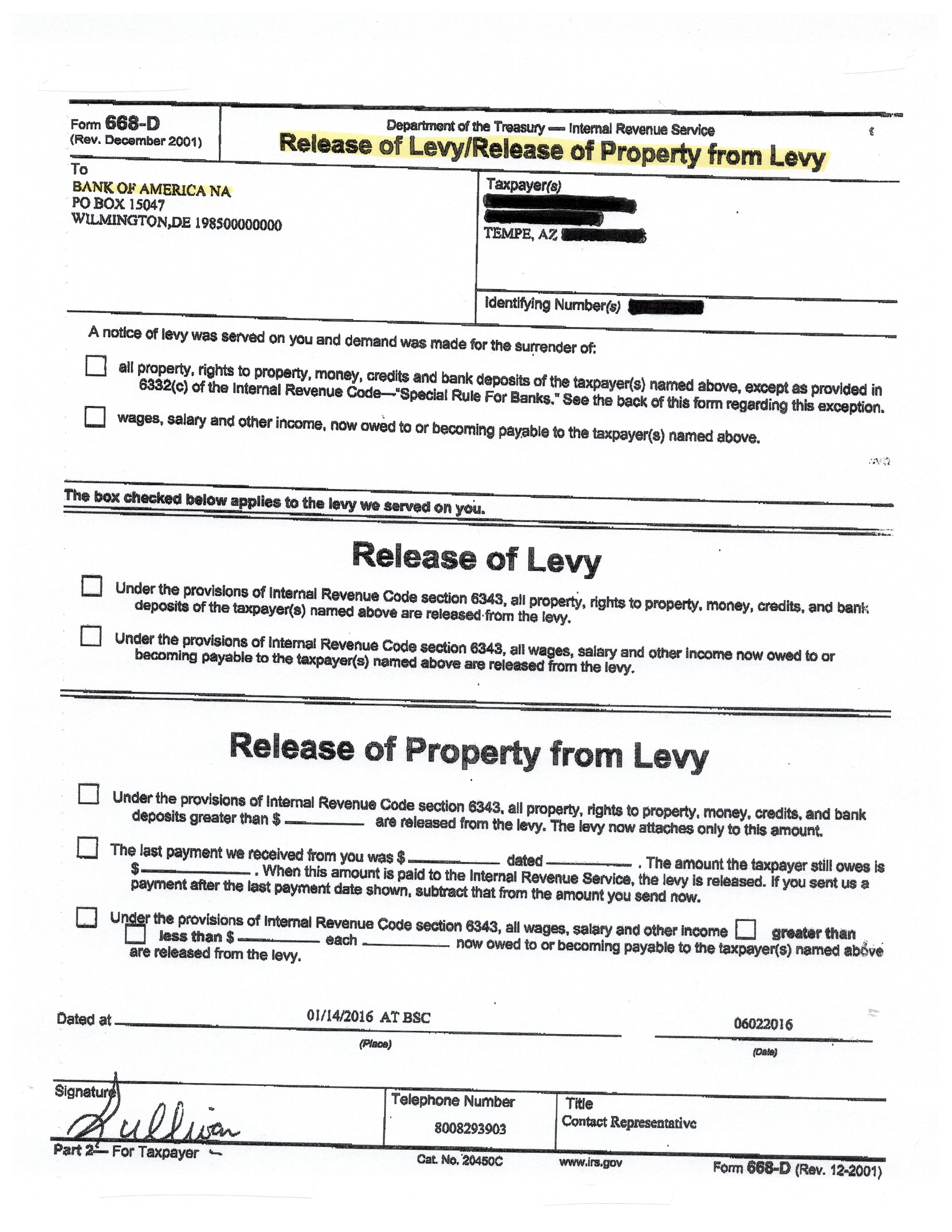

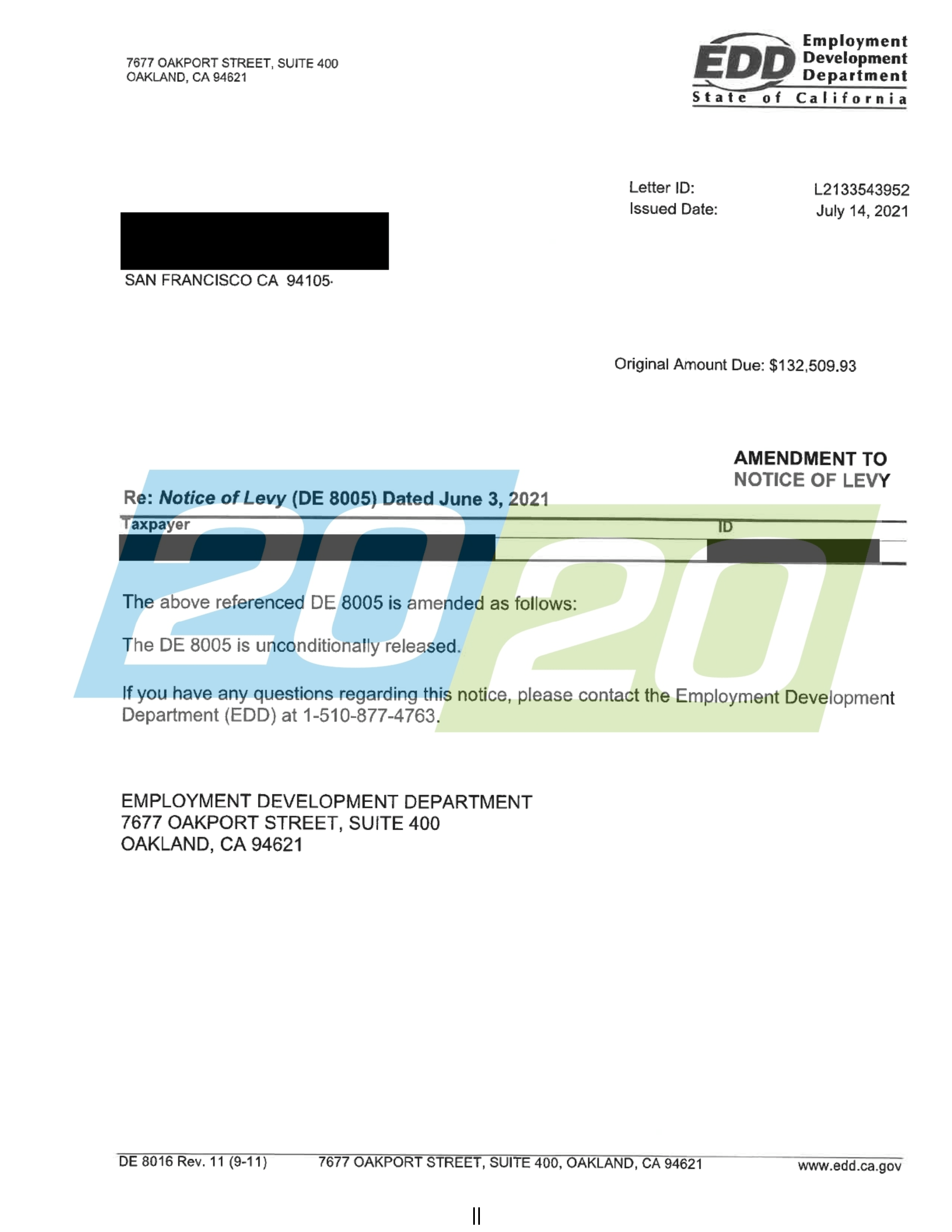

Notice of Levy from Department of the Treasury Internal Revenue Service to LULAC - 1977-06-24] - The Portal to Texas History